|

|

In this edition of Views and News, ETI is pleased to provide an analysis of competition in the wireless market; We also offer key insights into the FCC's recent Qwest Phoenix II order and its likely future impact on forbearance petitions and competitive analysis. We also offer a synopsis of a recent FCC workshop on such competitive analysis in the market for Special Access services.

Read on below, or navigate over to

econtech.com

where you can read online, or download a

printer-friendly version.

|

|

Wireless Markets: No Longer "Effectively Competitive"?

|

|

The FCC recently released its 14th annual report on Commercial Mobile Radio Service (CMRS) competition – an annual summary of the wireless marketplace and report to Congress. This new edition is similar to past CMRS reports, providing coverage maps, industry statistics, and narratives about the industry. But one aspect of the current report represents a major departure from any of the previous releases in this series: The Commission having repeatedly declared the US wireless market to be “effectively competitive” in each of the first thirteen CMRS Reports, that pronouncement is nowhere to be found in the 2010 version.

The FCC recently released its 14th annual report on Commercial Mobile Radio Service (CMRS) competition – an annual summary of the wireless marketplace and report to Congress. This new edition is similar to past CMRS reports, providing coverage maps, industry statistics, and narratives about the industry. But one aspect of the current report represents a major departure from any of the previous releases in this series: The Commission having repeatedly declared the US wireless market to be “effectively competitive” in each of the first thirteen CMRS Reports, that pronouncement is nowhere to be found in the 2010 version.

To be fair, the Commission doesn’t expressly reverse its previous conclusion by declaring that effective competition is absent from the wireless marketplace. Rather, the Report simply acknowledges that there is a lot of data out there, and a very comprehensive review will be required in order for it to make definitive determinations as to the actual level of competition. While the Report does not explain what would need to be shown to demonstrate that the CMRS market is “effectively competitive,” it does contain specific data that sheds light upon the status and direction of competition in the wireless industry. Indicia such as market share, profitability and contract terms and conditions all suggest that the FCC is on the right track in refusing to declare victory – i.e., that widespread “effective competition” is now present in all wireless sectors.

Continue reading at econtech.com

|

|

FCC denial of Qwest's Phoenix Forbearance Petition highlights new focus on carrier market power

|

|

Earlier this summer the FCC released what many hope is a precedent-setting Order denying a Qwest Petition for regulatory forbearance from most of the Commission’s remaining Title II regulations in the Phoenix metropolitan statistical area (MSA). This was Qwest’s second attempt at gaining full deregulation in Phoenix and for the second time it was unable to make a viable case for deregulation. More noteworthy than the Commission’s rejection of what can most charitably be described as an over-aggressive deregulatory Petition was the FCC’s analysis underlying the denial: the June 22, 2010 Qwest Phoenix II Order represents a dramatic departure from the competitive analyses the FCC has been employing for the last decade. Earlier forbearance rulings had been premised upon a theoretical and factual foundation that “predicted” competitive growth, drawing upon anecdotal competitive evidence, rather than any formal quantitative analysis of the carrier’s market power. In the Qwest Phoenix II Order, however, the FCC has now laid out and applied an antitrust type of “analytical framework” involving a comprehensive market power analysis with a strong emphasis upon market definition, market share, and other quantitative indicia of actual competition. This rigorous approach can be expected to form the basis for review of future ILEC Forbearance Petitions as well as for other regulatory reviews – most notably the FCC’s ongoing Special Access investigation.

Earlier this summer the FCC released what many hope is a precedent-setting Order denying a Qwest Petition for regulatory forbearance from most of the Commission’s remaining Title II regulations in the Phoenix metropolitan statistical area (MSA). This was Qwest’s second attempt at gaining full deregulation in Phoenix and for the second time it was unable to make a viable case for deregulation. More noteworthy than the Commission’s rejection of what can most charitably be described as an over-aggressive deregulatory Petition was the FCC’s analysis underlying the denial: the June 22, 2010 Qwest Phoenix II Order represents a dramatic departure from the competitive analyses the FCC has been employing for the last decade. Earlier forbearance rulings had been premised upon a theoretical and factual foundation that “predicted” competitive growth, drawing upon anecdotal competitive evidence, rather than any formal quantitative analysis of the carrier’s market power. In the Qwest Phoenix II Order, however, the FCC has now laid out and applied an antitrust type of “analytical framework” involving a comprehensive market power analysis with a strong emphasis upon market definition, market share, and other quantitative indicia of actual competition. This rigorous approach can be expected to form the basis for review of future ILEC Forbearance Petitions as well as for other regulatory reviews – most notably the FCC’s ongoing Special Access investigation.

Continue reading at econtech.com

|

|

ETI urges FCC to extend its use of quantitative market-power based analysis to the special access market at FCC economists workshop

|

|

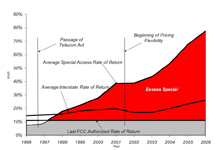

More than a decade after introducing “pricing flexibility” into the ILECs’ special access market, the FCC appears to have re-engaged in its investigation of the impact that this deregulatory policy has had over this period. In support of this effort, the FCC is currently in the midst of an investigation of the proper “Analytical Framework” for evaluating the functioning of the special access market as part of its long-running Investigation (CC Docket No. 05-25) into the effectiveness (or, as many believe, the harmfulness) of its deregulatory initiatives. Dr. Lee Selwyn, ETI’s president, was asked to participate in an “economists workshop” on this issue, which was held at the FCC on July 19. Dr. Selwyn’s participation was on behalf of some of the country’s largest enterprise customers that comprise the Ad Hoc Telecommunications Users Committee. In keeping with positions long advocated by ETI in a number of expert submissions and white papers presented at the FCC, at the Canadian Radio-Television and Telecommunications Commission, and at many state public utility regulatory agencies, Dr. Selwyn urged the FCC to forego its past reliance upon “predictive judgments” and often superficial anecdotal evidence of isolated instances of competitive entry in favor of a formal antitrust type of quantitative analysis of the incumbent carriers’ market power with respect to special access services. Dr. Selwyn noted that this was precisely what the Commission had done in its recent action rejecting Qwest’s Phoenix MSA forbearance petition (see companion article), and stressed the importance of applying this same approach to special access.

More than a decade after introducing “pricing flexibility” into the ILECs’ special access market, the FCC appears to have re-engaged in its investigation of the impact that this deregulatory policy has had over this period. In support of this effort, the FCC is currently in the midst of an investigation of the proper “Analytical Framework” for evaluating the functioning of the special access market as part of its long-running Investigation (CC Docket No. 05-25) into the effectiveness (or, as many believe, the harmfulness) of its deregulatory initiatives. Dr. Lee Selwyn, ETI’s president, was asked to participate in an “economists workshop” on this issue, which was held at the FCC on July 19. Dr. Selwyn’s participation was on behalf of some of the country’s largest enterprise customers that comprise the Ad Hoc Telecommunications Users Committee. In keeping with positions long advocated by ETI in a number of expert submissions and white papers presented at the FCC, at the Canadian Radio-Television and Telecommunications Commission, and at many state public utility regulatory agencies, Dr. Selwyn urged the FCC to forego its past reliance upon “predictive judgments” and often superficial anecdotal evidence of isolated instances of competitive entry in favor of a formal antitrust type of quantitative analysis of the incumbent carriers’ market power with respect to special access services. Dr. Selwyn noted that this was precisely what the Commission had done in its recent action rejecting Qwest’s Phoenix MSA forbearance petition (see companion article), and stressed the importance of applying this same approach to special access.

Continue reading at econtech.com

|

|

|

|

About ETI. Founded in 1972, Economics and Technology, Inc. is a leading research and consulting firm specializing in telecommunications regulation and policy, litigation support, taxation, service procurement, and negotiation. ETI serves a wide range of telecom industry stakeholders in the US and abroad, including telecommunications carriers, attorneys and their clients, consumer advocates, state and local governments, regulatory agencies, and large corporate, institutional and government purchasers of telecom services. |

|

|