|

|

Continue reading ETI Views and News at

econtech.com, or download a

printer-friendly version.

|

|

Market Structure Regulation Will Lead to Increased Competition and Stimulate Increased Investment and Jobs

|

|

A recent ETI report, Regulation, Investment and Jobs: How Regulation of Wholesale Markets Can Stimulate Private Sector Broadband Investment and Create Jobs, demonstrates that the most powerful tool the FCC has at its disposal to advance its broadband agenda and revitalize the telecommunications industry's economic engine is competition. Contrary to RBOC claims, by returning to policies like those implemented immediately following TA96 that were intended to ensure that ILEC wholesale access facilities are ubiquitously available and fairly priced, the FCC has the opportunity to set in motion a new era of innovation, investment and job growth in the telecommunications industry. ETI does not support a return to the traditional rate of return- based regulation of the last century, but instead urges adoption of broad market structure regulations designed to ensure the most efficient use of the nation's existing and future network infrastructure.

A recent ETI report, Regulation, Investment and Jobs: How Regulation of Wholesale Markets Can Stimulate Private Sector Broadband Investment and Create Jobs, demonstrates that the most powerful tool the FCC has at its disposal to advance its broadband agenda and revitalize the telecommunications industry's economic engine is competition. Contrary to RBOC claims, by returning to policies like those implemented immediately following TA96 that were intended to ensure that ILEC wholesale access facilities are ubiquitously available and fairly priced, the FCC has the opportunity to set in motion a new era of innovation, investment and job growth in the telecommunications industry. ETI does not support a return to the traditional rate of return- based regulation of the last century, but instead urges adoption of broad market structure regulations designed to ensure the most efficient use of the nation's existing and future network infrastructure.

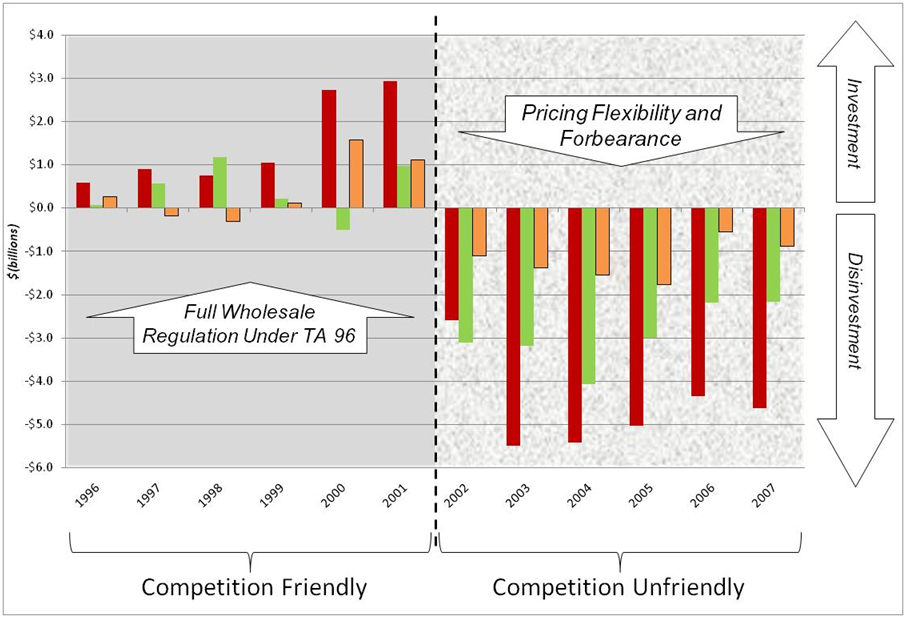

In a previous ETI report published in the spring of 2009, The Role of Regulation in a Competitive Environment, we demonstrated that the “competition-friendly” regulatory policies in effect during the five years immediately following the 1996 Act spurred incumbents and competitors alike to invest or expand their investments in telecommunications facilities. During that time, comprehensive unbundling requirements of the new Sections 251 and 252 of the 1996 legislation, along with relatively strict enforcement of the rate-constraining mandates of Sections 201 and 202 of the Communications Act of 1934, were intended to ensure that competitors could purchase local transmission facilities, as either unbundled network elements (UNEs) or as Special Access, at relatively low and nondiscriminatory prices. The availability of reasonably priced local transmission facilities regulated in this manner enabled competitors to serve broad segments of the telecommunications market nationwide. We also showed that with the subsequent shift to a “competition unfriendly” regulatory regime – when the FCC dismantled many core protections that had been instituted so as to assure the availability and economic pricing of wholesale inputs – conditions became so unfavorable to investment by competitive carriers that entrants were compelled to scale back their capital spending and, in many cases, to withdraw from the market altogether. Facing only limited remnants of the post-TA96 competition, the ILECs’ incentives to expand their own capital expenditures were diminished, and their investment outlays were scaled back accordingly. Thus, while the combined net book value of telecom plant for what is now AT&T, Qwest, and Verizon rose from $142-billion in 1996 to $155-billion in 2001, by 2007 it had dropped to only $101-billion.

Regulation, Investment and Jobs expands upon our earlier work and also examines the correlation between “competition-friendly” and “competition-unfriendly” regulatory regimes vs. telecom sector employment levels. Telecom sector jobs grew steadily between 1996 and 2000. Although some employment losses in 2001-2002 could be attributed to general economic factors (in particular, the collapse of the “tech bubble”), jobs in the telecom sector failed to rebound even as conditions in the general economy improved. With “competition- unfriendly” regulatory policies in place, the telecommunications sector has experienced steady and persistent job losses – a drop of more than 400,000 jobs, including the loss of 140,000 jobs at the regional Bells, between 2001 and 2007. The only segment of the telecommunications industry where employment increased was wireless where, during the relevant period, there had been four or more competitors in virtually every geographic market.

BOC net capital investments – 1996-2007 demonstrating that deregulation resulted in “disinvestment” rather than investment.

Click here to enlarge the chart.

In Regulation, Investment and Jobs, we also looked forward, charting the significant economic gains in terms of investment and employment that should be expected to arise as a direct result of restoring a competition-friendly regulatory regime:

• Stimulation of investment in high speed broadband infra-structure. A regulatory regime that is friendly to competitors can be expected to stimulate as much as $60-billion in new infrastructure investment over the next five years. Much of this will be geared toward serving business customer locations outside of the residential neighborhoods that have been the primary focus of ILEC and cableco broadband investment. This new competitive focus on the business market will make advanced broadband services more widely available to businesses of all sizes, and will help to forces prices down. Looking out to 2014, we developed forecasts of year-over-year investment growth and cumulative investment dollars based on three alternate sets of assumptions – the most realistic, moderate, and conservative. With reimposition of effective wholesale regulation, we project that the cumulative investment by ILECs and CLECs will increase between $20-billion (under the most conservative assumptions) and $60-billion (under the realistic scenario) by 2014, compared to the level of investment that can be expected to occur absent significant regulatory reform.

• Industry-wide job creation. The economic expansion resulting from restoring pro-competitive regulation of wholesale broadband services should lead to a large-scale growth in employment for ILECs and for CLECs, reversing the persistent job losses that occurred between 2001, when the FCC’s policy of deregulating wholesale broadband services was initiated, and the present. As with our investment analysis, we forecast year-over-year job additions and cumulative job growth over a five-year period using the same three assumption sets. Even applying the most conservative assumptions, we forecast that there will be 135,000 more telecom sector jobs by 2014 if the FCC restores effective regulation to broadband wholesale services than if it accedes to a continuation of the current deregulatory regime. Under what we believe to be a more realistic assumption set, job growth in that sector over the same period could exceed 450,000.

• Stimulation of economy-wide economic growth and job creation. The adverse economic effects of stifling competition for the broad range of retail services that depend on reasonably priced access to ILEC broadband network elements and special access services are not confined to the telecom industry itself. As such, the lower prices and innovative broadband offerings stemming from a more competitive telecom sector can be expected to flow through to the general economy, resulting in greater productivity and increased employment across all economic sectors. The inefficiency in the general economy as a result of special access overpricing has been compounding for close to a decade. We estimate that through 2009 forgone GDP growth has been in the range of $66-billion, and that the general economy (excluding telecom) could have supported 234,000 more jobs had the economic benefits of competitive special access pricing been flowed to businesses economywide.

Click here to download the entire report.

Read the rest of Views and News, May 2010.

|

|

|

|

About ETI. Founded in 1972, Economics and Technology, Inc. is a leading research and consulting firm specializing in telecommunications regulation and policy, litigation support, taxation, service procurement, and negotiation. ETI serves a wide range of telecom industry stakeholders in the US and abroad, including telecommunications carriers, attorneys and their clients, consumer advocates, state and local governments, regulatory agencies, and large corporate, institutional and government purchasers of telecom services. |

|

|