|

|

Continue reading ETI Views and News at

econtech.com,

or download a

printer-friendly version.

|

|

ETI urges FCC to extend its use of quantitative market-power based analysis to the special access market at FCC economists workshop

|

|

More than a decade after introducing “pricing flexibility” into the ILECs’ special access market, the FCC appears to have re-engaged in its investigation of the impact that this deregulatory policy has had over this period. In support of this effort, the FCC is currently in the midst of an investigation of the proper “Analytical Framework” for evaluating the functioning of the special access market as part of its long-running Investigation (CC Docket No. 05-25) into the effectiveness (or, as many believe, the harmfulness) of its deregulatory initiatives. Dr. Lee Selwyn, ETI’s president, was asked to participate in an “economists workshop” on this issue, which was held at the FCC on July 19. Dr. Selwyn’s participation was on behalf of some of the country’s largest enterprise customers that comprise the Ad Hoc Telecommunications Users Committee. In keeping with positions long advocated by ETI in a number of expert submissions and white papers presented at the FCC, at the Canadian Radio-Television and Telecommunications Commission, and at many state public utility regulatory agencies, Dr. Selwyn urged the FCC to forego its past reliance upon “predictive judgments” and often superficial anecdotal evidence of isolated instances of competitive entry in favor of a formal antitrust type of quantitative analysis of the incumbent carriers’ market power with respect to special access services. Dr. Selwyn noted that this was precisely what the Commission had done in its recent action rejecting Qwest’s Phoenix MSA forbearance petition (see companion article), and stressed the importance of applying this same approach to special access.

More than a decade after introducing “pricing flexibility” into the ILECs’ special access market, the FCC appears to have re-engaged in its investigation of the impact that this deregulatory policy has had over this period. In support of this effort, the FCC is currently in the midst of an investigation of the proper “Analytical Framework” for evaluating the functioning of the special access market as part of its long-running Investigation (CC Docket No. 05-25) into the effectiveness (or, as many believe, the harmfulness) of its deregulatory initiatives. Dr. Lee Selwyn, ETI’s president, was asked to participate in an “economists workshop” on this issue, which was held at the FCC on July 19. Dr. Selwyn’s participation was on behalf of some of the country’s largest enterprise customers that comprise the Ad Hoc Telecommunications Users Committee. In keeping with positions long advocated by ETI in a number of expert submissions and white papers presented at the FCC, at the Canadian Radio-Television and Telecommunications Commission, and at many state public utility regulatory agencies, Dr. Selwyn urged the FCC to forego its past reliance upon “predictive judgments” and often superficial anecdotal evidence of isolated instances of competitive entry in favor of a formal antitrust type of quantitative analysis of the incumbent carriers’ market power with respect to special access services. Dr. Selwyn noted that this was precisely what the Commission had done in its recent action rejecting Qwest’s Phoenix MSA forbearance petition (see companion article), and stressed the importance of applying this same approach to special access.

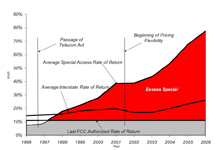

Dr. Selwyn also explained why the Commission could not rely upon its use of price cap regulation as a backstop means for limiting pricing excesses in pricing flexibility areas. He noted that most of the protections against excessive ILEC pricing and profits that had been engineered into the FCC’s original ILEC price cap plan – adopted back in 1990 – have long since been abandoned by the Commission. These measures had included periodic reviews intended to evaluate both the ongoing workings of price caps as well as a determination as to whether its specific price adjustment elements had been correctly specified. In the original price cap plan, realized rates of return were relied upon as indicia of a properly functioning regulatory system, and excessive earnings were subject to “sharing” with consumers (to assure that any efficiency gains realized under incentive regulation would be flowed through in lower prices) and, if earnings exceeded a specified upper bound, downward adjustments in rates would be automatically implemented. With each and all of these features now gone, what remains of price caps is incapable of assuring just and reasonable rate levels without additional regulatory involvement.

Dr. Selwyn defended the use of rate of return analysis in evaluating price levels against RBOC critiques and FCC uncertainty – citing AT&T’s own use of the identical type of earnings and regulatory accounting data its recent complaint regarding NECA switched access price levels. While maintaining his long held view as to the usefulness of regulatory accounting and rate of return data as a valid basis for identifying the presence of excessive ILEC prices, Dr. Selwyn also supported the use of alternate benchmarks, such as the use of UNE prices or TELRIC-based costs in place of one based upon realized earnings.

Dr. Selwyn also explained that the collocation-based triggers that form the basis of the FCC’s pricing flexibility rules were flawed from the outset and never offered any useful insight as to the actual level of competition extant in the special access market – particularly the market for last mile channel terminations. Introducing the only empirical evidence to make its way into the debate, Dr. Selwyn presented data showing that even if, arguendo, the triggers were useful at the time they were implemented, the FCC rules did not provide any mechanism for reviewing and reversing pricing flexibility if the trigger status changed. Citing Verizon data from a 2001 New Jersey regulatory proceeding, Dr. Selwyn demonstrated that in the year following the FCC’s initial grant of pricing flexibility to Verizon in certain New Jersey MSAs, the number of collocations declined by more than 60%, and further noted that some portion of the remaining 40% likely belonged to MCI before it was absorbed into Verizon in 2006.

The workshop was conducted as a facilitated debate led by Dr. Jonathan Baker, the FCC’s Chief Economist, with questions also asked by Dr. Donald Stockdale, Deputy Bureau Chief/Chief Economist of the FCC’s Wireline Competition Bureau. Two of the four economists invited to participate in the workshop represented enterprise customer and competitive carrier interests (Dr. Selwyn and Dr. Bridger Mitchell of CRA International). The other two supported RBOC positions relating to Special Access pricing (Dennis Carlton of Compass Lexecon and William Taylor of NERA).

A video link to the FCC debate will be available on the ETI website as soon the FCC makes the feed available.

If you would like more information on this subject, please contact Dr. Lee L. Selwyn.

Read the rest of Views and News, July 2010.

|

|

|

|

About ETI. Founded in 1972, Economics and Technology, Inc. is a leading research and consulting firm specializing in telecommunications regulation and policy, litigation support, taxation, service procurement, and negotiation. ETI serves a wide range of telecom industry stakeholders in the US and abroad, including telecommunications carriers, attorneys and their clients, consumer advocates, state and local governments, regulatory agencies, and large corporate, institutional and government purchasers of telecom services. |

|

|